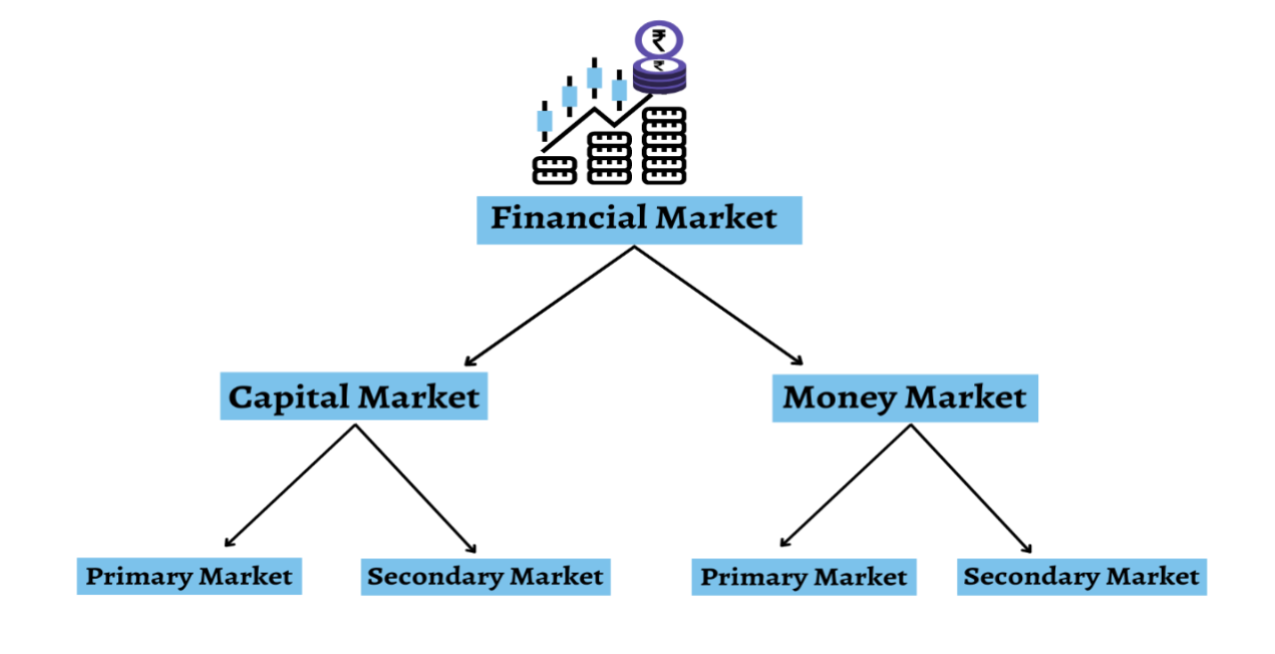

Hierarchy

Brings buyers and sellers together to trade in financial securities or assets. They are of 2 types:

- Capital Market

- Money Market

Call Market

For buying/selling debt and equity. Securities of medium & long term of 1yr are traded.

Primary capital market

- market here securities are created (eg. via IPO)

- transaction between issuer (company) and investor

Secondary capital market

- securities issued in primary market are traded here among investors

- eg. BSE

Money Market

High liquidity and very short maturities 1yr are traded. Debt instruments like

- call/notice money

- Certificate of Deposits

- CBLO

- Commercial Paper

- Cash Management Bills

- Treasury Bills

- Repos

Who can trade? FI, commercial banks, central banks, highly rated corporates