- issued by Basel Committee on Banking Supervision (BCBS)

- Basel (Switzerland) is HQ for Bureau of International Settlements (BIS)

- BIS promotes cooperation among central banks w/ common goal of financial stability and banking regulatory standards

- Basel Accords: set of agreements by BCBS primarily addressing risks associated w/ banks & financial system

- accepted by India

- in fact, RBI has more stringent standards on few parameters than BCBS

Goal of Basel Norms

Ensuring that FI have sufficient capital to meet obligations and absorb expected losses.

Basel I

- introduced capital mgmt system Basel Capital Accord 1988

- India adopted it in 1991

- entirely concerned with credit risk

- no concern for market & operational risk

- estd. capital and risk weighed structure for bank in form of Capital Adequacy Ratio (CAR 🚗)

What are Risk Weighted Assets?

- weighing bank’s assets (i.e. loans) in context of the associated risk

- eg. credit card loans most risky as they have no security other than promise

- secured loans safer as collateral can be used to recover loan amount even if borrower does not pay back

- more risk taken by bank more capital needed to protect depositors

- required minimum capital 8% of RWA

- but RBI enforces 9%

Types of Capital

Tier I

- bank’s core capital

- primary measure of bank’s financial strength

- very liquid, can be used w/o shutting down operations

- incl. retained earnings

- majority of core capital is made of disclosed reserves, equity

- most of the equity portion will be common equity which will have no conditions attached

Tier II

- used for supplemental funding since less reliable

- incl. undisclosed reserves (from bank owners), preferential shares, subordinate debt

Basel II

- June 2004

- considered to be refined and reformed version of Basel I

Guidelines were formed on 3 pillars:

- Capital Adequacy Requirements

- same at 8%, but now considered all 3 risks:

- credit

- market

- operational

- same at 8%, but now considered all 3 risks:

- Supervisory Review

- banks required to develop & implement better risk mgmt techniques for monitoring & managing all 3 types of risks

- Market Discipline

- requires strict disclosure requirements

- banks must report their CAR, Risk exposure, other info to central bank on regular basis

After 2008 financial crisis & collapse of Lehmann Brothers Bank, the need for better guidelines was seen.

Basel III

- in the wake of Lehmann Brothers collapse & financial crisis, BCBS decided to strengthen norms

- new guidelines intended to promote more resilient banking system, by focusing on 4 critical banking parameters

- capital

- leverage

- funding

- liquidity

- focus on better capital quality, which came from higher loss absorbing capacity

- also suggested addl. capital conservation buffers and counter cyclical buffers

Capital Conservation Buffer

- banks must hold capital conservation buffer of 2.5%

- focus of this buffer to ensure banks maintain a cushion of capital that can be used to absorb losses during periods of financial & economic stress

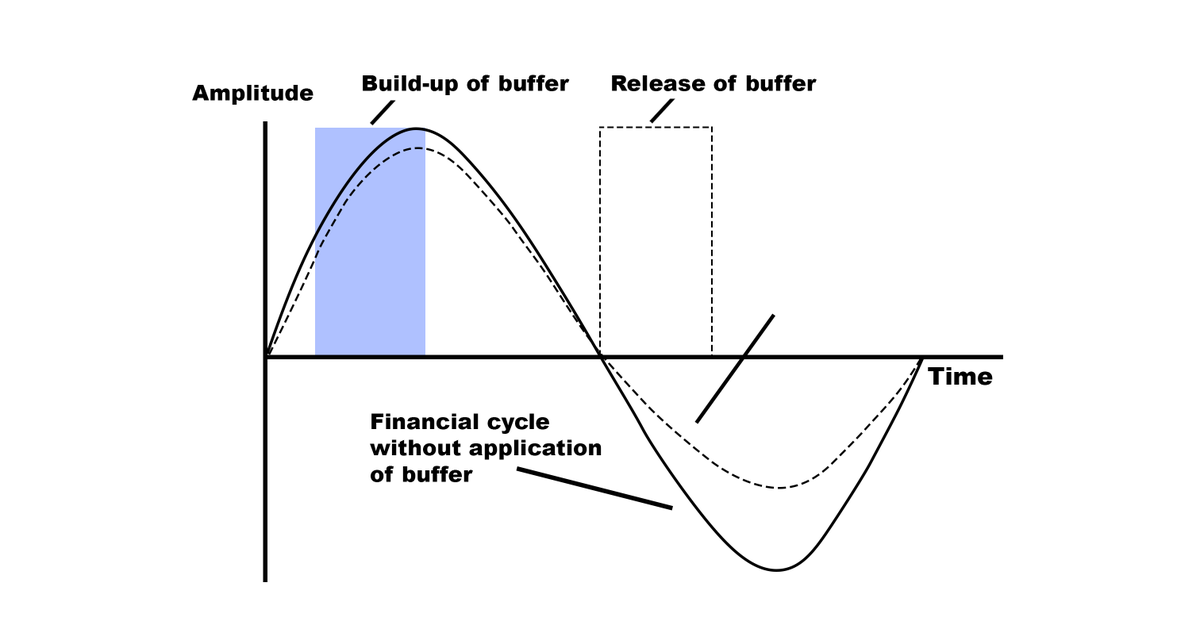

Countercyclical Buffer

- introduced w/ objective of:

- increasing capital requirements during good times

- decreasing during crisis

- buffer will slow down banking activities when economy overheats and it’ll encourage lending during crisis

- buffer will range from 0-2.5% & will consist of common equity or other loss absorbing capital

- it’s buffer of capital maintained by banks in good times, which may be used to maintain credit flow in difficult times

- will discourage banks from giving too many loans during good economic conditions

- some of them may become NPA when economic conditions weak

- maintaining CCB will also reduce lending ability of bank

- banks bust set aside CCB so that banks remain adequately capitalized when loans extended by banks start turning into bad loans